Customer Owned Transaction Records

The Customer Transaction Record (CTR) is a statement containing information about the money paid for a product or service. When you purchase a product or service online, the transaction record is captured in the merchant/service provider’s database, and you receive an electronic invoice for your purchase via email or some other digital format. If you purchase a product or service offline (e.g., at a brick-and-mortar establishment), the merchant/service provider captures your payment electronically but gives you a paper invoice. An electronic record of the transaction invoice is of tremendous value both to the merchant/service provider and the customer. Merchants and service providers can learn about a customer’s purchasing behavior and run loyalty programs and targeted advertising campaigns on the back of customer transaction records. Customers can potentially use the transaction records to understand their spending and also leverage the same to receive reward points or cashback from merchants/service providers.

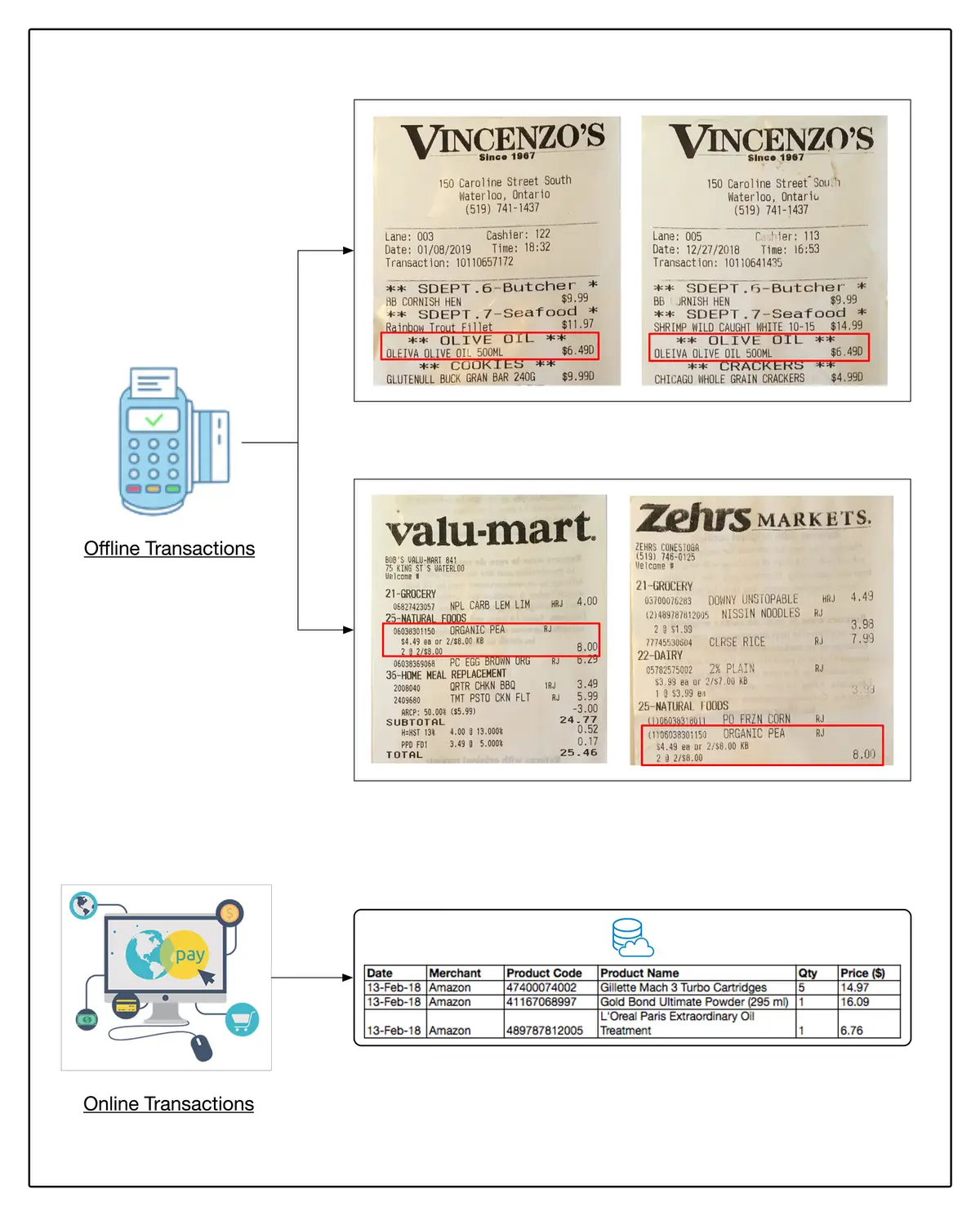

Most customers do not have access to CTRs in an electronic format. Merchants and service providers typically distribute the CTR to customers in paper format and keep electronic copies of the transaction record in their data silos that are typically out of bounds of customers and the rest of the world. The illustration below shows a few examples of offline/online Customer Transaction Records representative of this problem.

The Customer Transaction Record is logically the customer’s property since he/she was responsible for its creation. If the customer does not purchase a product or service, the transaction record is not created. So why do many merchants/service providers retain a copy of customer transaction records and the associated customer profile in their databases? How does this process work, and what can we do to reverse the ownership such that the CTR is exclusively owned by the customer and shared anonymously with a merchant/service provider only with the customer’s consent?

Problems with the retention of Customer Transaction Records

Many merchants/vendors and some banks issue co-branded payment cards to customers, and the customers earn reward points or cashback every time they make a purchase at a designated store or business establishment using the co-branded card. When customers take a co-branded payment card from a merchant/vendor or bank, they sign up for an agreement with the card issuer whereby their transaction records are retained by the merchant/vendor or bank and used for promotions, business insights, etc. Merchants, vendors, and banks do not share customer transaction records with their competitors and must abide by any applicable privacy laws specified by the regulator (typically a government body). The said practice, although favorable both to merchants/service providers and customers, is limited in scope and benefits. When a customer is issued a co-branded card, he/she earns reward points or cashback only if the card is used at establishments that are a part of the issuer’s network. If the customer uses the co-branded card at an establishment not part of the network, the customer receives no benefit because the card issuer does not profit from a purchase initiated outside its network.

A customer retention system linked to a merchant/service provider-specific payment card has other problems as well. Every time a customer signs up for a co-branded payment card, they give their private and confidential information to a business that may be unable to protect the information from theft and/or misuse. Secondly, when a customer signs up for another payment card, the number of cards they need to store and manage increases. Although there are mobile apps that allow customers to manage payment cards via a smartphone, they require several steps to activate and deactivate, thereby increasing the time spent at the POS during a purchase.

Proposal for Inverted Ownership of Customer Transaction Records

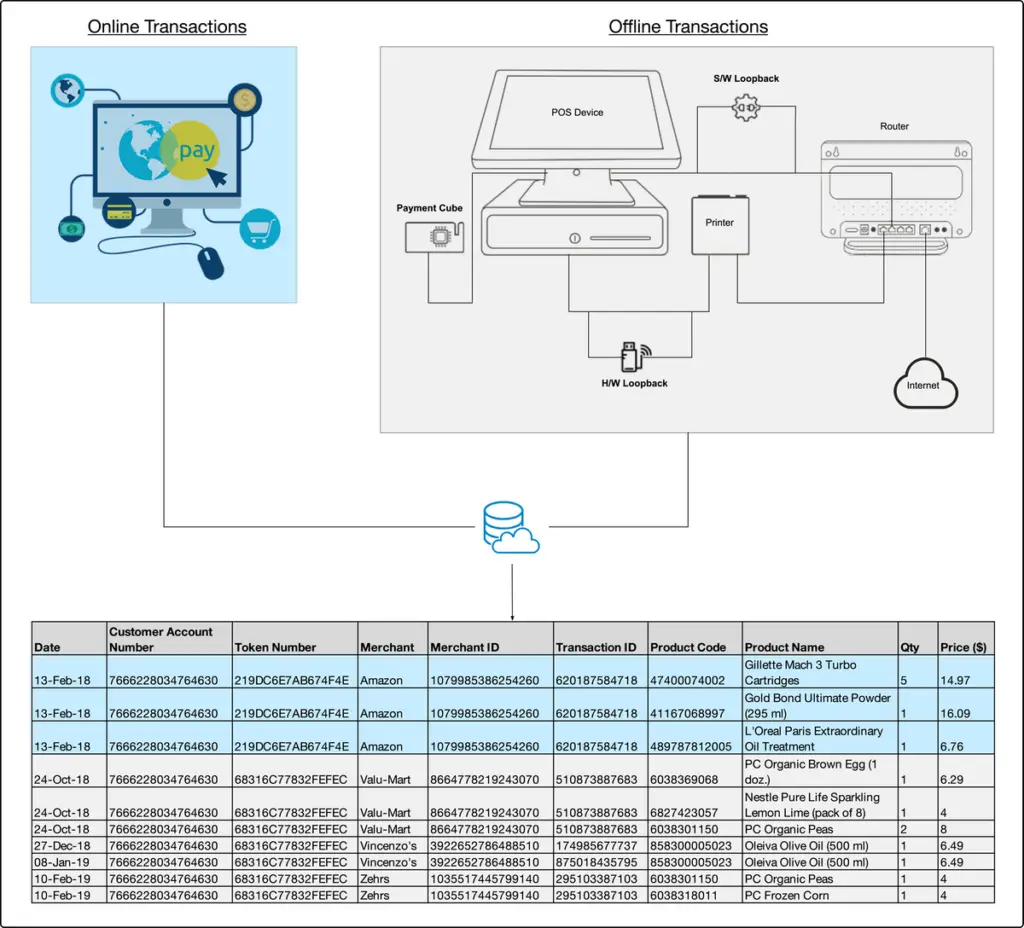

The problem with retention of customer transaction records is surprisingly easy to solve given the cooperation of banks, payment card processors (e.g., Visa, MasterCard), merchants/service providers, and customers. Let’s understand the solution with the help of the diagram given below. The diagram shows two boxes representing Online Transactions and Offline Transactions, respectively. The Online Transactions box contains a picture of a computer representing electronic commerce. The Offline Transactions box contains a picture of a Point of Sale (POS) setup comprising a Payment Cube, a POS Device, a Router, and a Printer. In the diagram, there are three modifications too. The Payment Cube has a Microchip to write a transaction record on a payment card, the connection between the POS Device and the Router has a Software Loopback, and the connection between the POS Device and the Printer has a Hardware Loopback. The Online Transactions and Offline Transactions boxes are both connected to a Customer Account containing its transaction records stored on a cloud server.

Unlike the previous diagram that showed the same transaction records locked in the silos of different merchants and distributed to the customer in different formats (paper and digital), the new diagram shows a single entity containing all of the transaction records. The new diagram is a model for inverted ownership of Customer Transaction Records. What are the benefits of keeping all transaction records in a centralized database? How does it benefit customers, merchants/service providers, and the world? How can all transaction records be kept in one database without compromising the private and confidential information about customers? Let’s answer all these questions one at a time.

Advantages of a Centralized Database of CTRs

A customer transaction record is a window to a person’s taste, preferences, and spending habits. When a customer repeatedly purchases a product or visits the same service provider (e.g., a restaurant), he/she endorses the product or service provider. Alternatively, if the same customer switches between two competing products or visits a restaurant far away from their residence or workplace – even though there are many compelling options closer to the customer – he/she rejects the product or service provider. Market insights such as this can be very valuable to customers, businesses, and service providers. Customers can access the aggregate values of such information via a search engine and quickly locate a product, business, or service provider with greater customer retention. Likewise, businesses can also access the database containing customer tastes/preferences and use the information to plan their manufacturing and distribution capacities, advertising budgets, etc.

Saving CTRs in a centralized database creates a single source of truth (SSOT) and facilitates better online search, efficient marketing, higher productivity, and greater revenues.

The transaction record available to a customer through its bank or payment card issuer does not contain an itemized listing of products or services purchased by the customer. When a customer makes a purchase through their payment card, the merchant/service provider transmits information containing the merchant/service provider’s name, address, and the total value of the transaction to the card issuer. If the card issuer and the merchant are the same entities (e.g., in the case of a co-branded card), then the merchant has full information on the transaction, including the customer’s private and confidential information, such as his/her name, address, age, telephone number, and email. However, if the card issuer and the merchant are different entities, the transaction information is hidden from the card issuer, and the customer details are hidden from the merchant.

Recording CTRs in a Centralized Database on the Cloud

A customer transaction record does not need to be printed. It can be recorded electronically into the customer’s personal account instead, and the information captured can assist the customer, merchants/service providers, and the rest of the world. E-commerce portals like Amazon capture customer transaction records electronically in a structured format. This benefits Amazon as well as the customer. When Amazon captures a transaction record, it allows the customer to submit a review of the product that he/she acquired and purchase the same product again by clicking the transaction record. Amazon extracts significant market insights from the transaction records and uses the information to optimize its business processes. However, Amazon’s strategy for capturing customer transaction records is not the best. Firstly, Amazon requires that before a customer makes a purchase, he/she needs to add a payment method. This is typically a credit/debit card or an Amazon gift card. Secondly, Amazon requires customers to provide their email addresses when creating their Amazon account. These requirements give away a customer’s private and confidential information to Amazon. Finally, the customer transaction records captured by Amazon are not available to the customer’s trusted network or even the rest of the world. Since the data is locked in Amazon’s databases, it is impossible to aggregate the values of such records with the values from other sources of customer transaction records, such as another merchant/service provider’s transaction database.

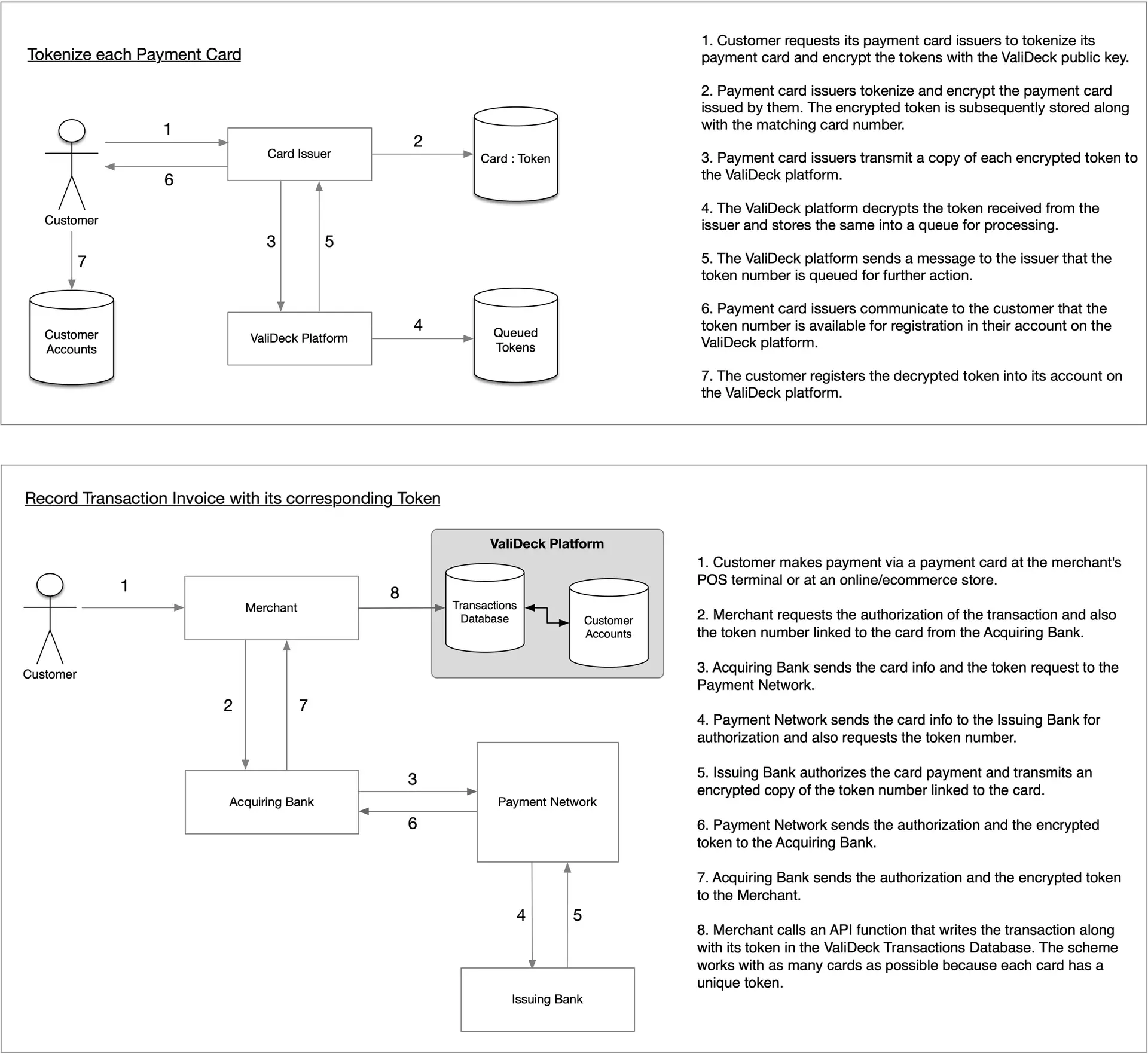

An e-commerce portal like Amazon or a brick-and-mortar store that provides co-branded payment cards can receive customer transaction records and run a loyalty program without requiring customers to provide their confidential information. This can be achieved via a unique Token Number mapped to every payment card a customer owns. To allow a merchant/vendor to run a loyalty program without a merchant-specific payment card or identifier, such as a QR code, the POS setup, as shown in the preceding graphic, is connected to a platform containing a transaction database. This allows the merchant/vendor and the customer to create their own accounts under the platform. The platform subsequently allows customers to add Token Numbers to their payment cards in their personal accounts. Customers can add Token Numbers to their personal accounts via their online banking accounts with the card issuer or dynamically during a transaction. Payment card issuers tokenize payment cards (via a one-way hash) at the cardholder’s request and provide an encrypted copy of the stored Token Number to the payment processor every time they receive a request for the Token Number. The platform uses Token Numbers to associate a payment card used during a transaction with the customer account containing the Token Number. The Token Number uniquely identifies a payment card but cannot be mathematically reversed to reveal the payment card number. It is encrypted with the public key of the platform and can be decrypted only via the matching private key deployed at the platform.

When a transaction is initiated, the transaction record may be saved in the customer’s and associated merchant’s accounts. The platform may link the customer’s transaction record with the merchant’s account if the customer is enrolled in the merchant’s loyalty program. If the customer is not enrolled in the merchant’s loyalty program and the merchant has created a loyalty program, the customer may be prompted to register with the merchant’s loyalty program. If the customer consents to enroll in the merchant’s loyalty program, the transaction record may be linked with the merchant’s account. If the customer declines to enroll in the merchant’s loyalty program, the customer action is recorded with the platform, and the customer is not prompted to register with the merchant’s loyalty program again. If the merchant has not created a loyalty program, the customer transaction record is saved in the customer’s account with the platform, and the merchant will not receive any information about the customer record.

The diagram below describes how this process will work.

Protecting Customersʼ Private and Confidential Information

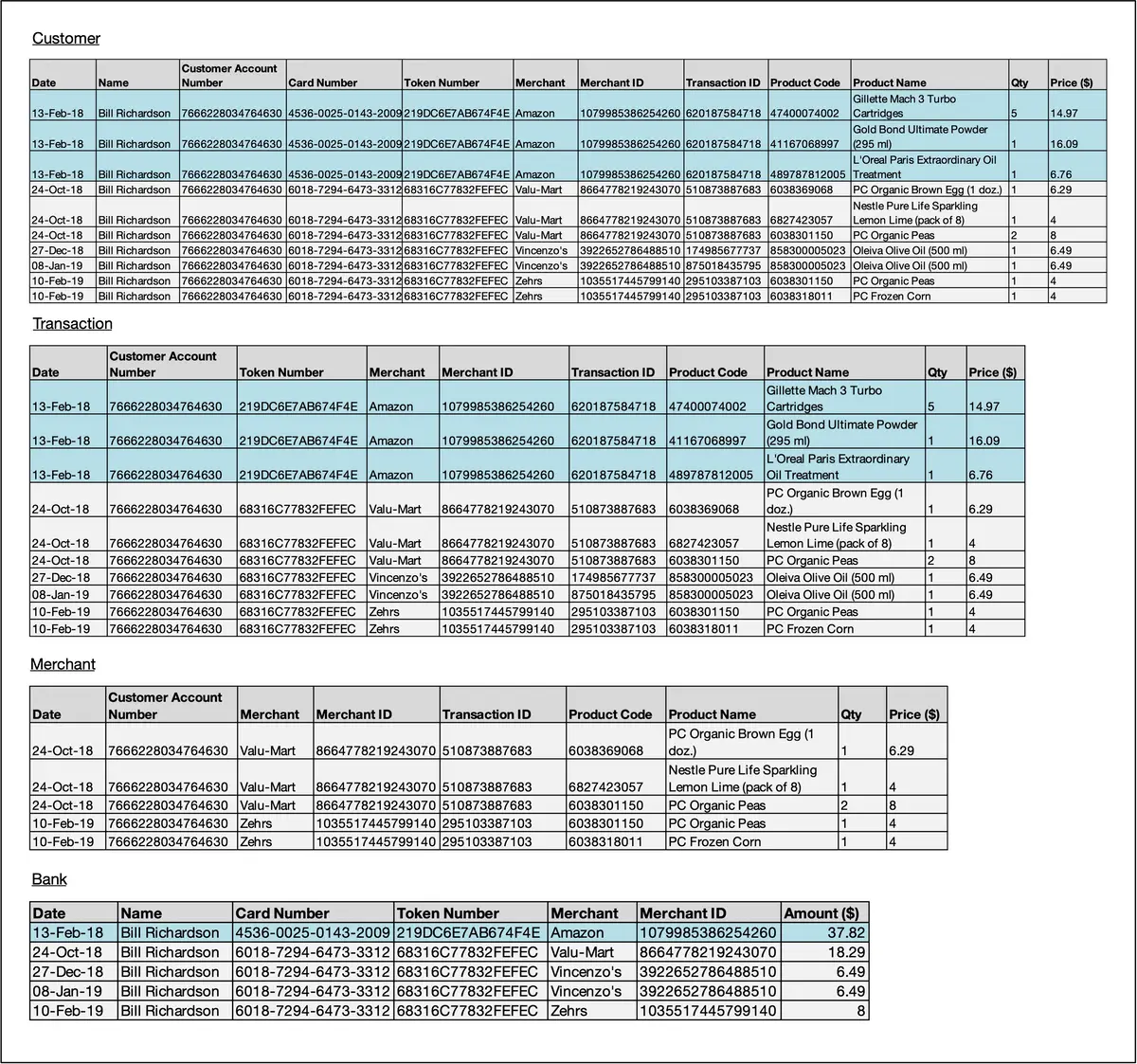

Transaction records captured in this manner allow customers to get instant visibility of their spending habits across payment methods and cards. The platform also allows a customer to join a merchant’s loyalty program without providing any confidential information about itself. The diagram below shows a snapshot of four database tables: Customer, Transaction, Merchant, and Bank. The information provided in the tables reveals that each party has visibility only on their own information. The Merchant has information on the transactions done by the customer (if the customer signed up for the merchant’s loyalty program) within its store/partner network and uses this information to compute the loyalty credits for the customer. However, consent is required from the customer before receiving information on the customer’s transactions outside its own store/partner network. It is understood that merchants would provide loyalty credits to a customer to receive such information. The Bank has information on customer spending across market segments but does not know how the money was spent because the transaction records are not shared with the bank. The Transaction database does not know the customer behind the Token Number because the Bank is not required to share this information with the platform hosting the Transaction database. The only party having full access to the transaction records is the customer making the purchases. The customer can share its transaction records with the other parties in the system without revealing its identity.

Final Thoughts

Albert Einstein said, “We cannot solve our problems with the same thinking we used to create them.” The Internet is flooded with fake and manipulated information because big businesses have eliminated competition from the market. A centralized repository of reviews and customer transaction records can restore the credibility of online information and create a level playing field for small and medium businesses.

Most people throw their transaction invoice soon after accepting the sale unless the purchase comprises items that are either high value (e.g., television, cellphone) or require the correct fit (e.g., apparel). When an invoice is retained, it is mostly in a format that is not amenable to electronic processing. A centralized repository of Customer Transaction Records can assist in capturing contextually relevant feedback for every product/service provider via quick and easy forms. When transaction records are stored at a central location, it also becomes possible to analyze spending, check transactions, measure consumer behavior, lookup reviews, and identify service providers trusted by our social network.

On October 20, 1968, at the Mexico Olympics, Richard Douglas Fosbury (aka Dick Fosbury) created sporting history when he jumped a high bar placed at 2.24 meters with a revolutionary technique that he had started experimenting with at age 16. Unlike other athletes who used the straddle-roll or the scissors technique to clear the bar, Fosbury approached the target in the reverse direction – with his back facing the bar. The Fosbury Flop technique was superior to the other two techniques because it allowed the jumper to lower its center of mass below the target and clear the hurdle with less energy. The Fosbury Flop technique is often used as a metaphor to convey out of the box thinking and emphasize that innovative ideas are discovered through intuition rather than hard work.

Customer-owned transaction records offer a solution to the problems we have created for ourselves. The solution is innovative, futuristic, and compliant with the laws of regulatory institutions worldwide.