Frequently Asked Questions (FAQs)

ValiDeck is currently still a concept, therefore you cannot see an MVP of the product. To build and deploy the ValiDeck concept with a small group of businesses, we need an investment of USD 3 million. This investment will be used to develop a:

- Payment Transaction Simulator.

- Point of Sale (PoS) prototype to link payment card tokens with customer transaction records.

- ValiDeck server platform prototype to save anonymous customer transaction records.

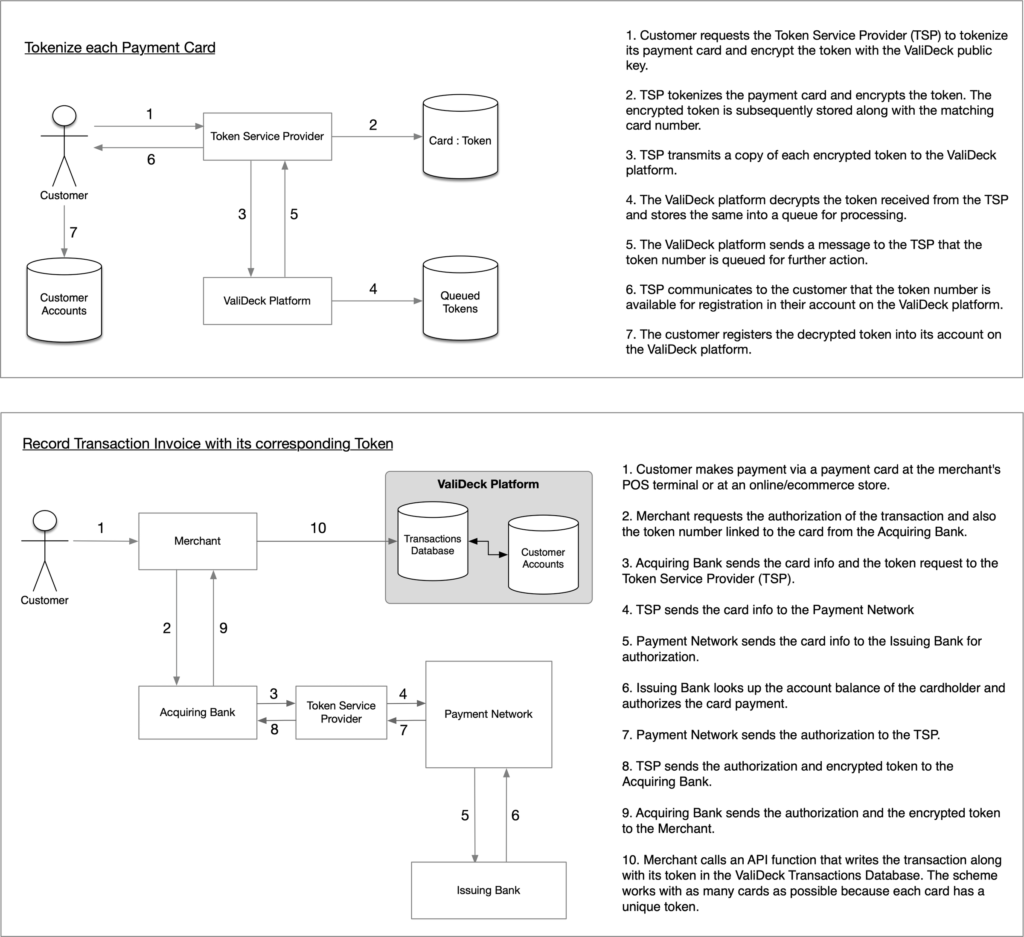

Since our concept is deeply connected with the tokenization process, we’ve initiated a conversation with a token service provider (TSP) with the technological infrastructure to assist us in developing and implementing the MVP. In our production design, we’ve assigned the responsibility of tokenization to the payment card issuer. This will take some time to happen because the PCI standard will need to be amended to allow this specification. In order to build and deploy an MVP, we’ll assign the responsibility of tokenization to the TSP. The following illustration shows how the tokenization will work inside an MVP environment.

The ValiDeck platform captures and indexes the transaction records and reviews of its account holders in a centralized database. An example of a transaction record is the invoice that you receive when you buy a product or pay for a service. An example of a review is the feedback that you submit for a product or service that you purchased.

Currently, no company provides a method for Internet users to capture all of their transaction records and reviews at a central location. When a customer purchases a product from a vendor, the transaction record is given to the customer as a printed invoice or electronically stored in their account with the vendor. Similarly, when a customer submits a review of a product or service, the review is locked in the vendor’s database. In both situations, crucial data about the quality of a product or service becomes unavailable to a web crawler that indexes this data for search engines.

ValiDeck aggregates the transaction records and reviews of its account holders by allowing them to capture their data anonymously. The collected information becomes the index of the ValiDeck search engine. ValiDeck search results are derived from the:

- subjective/objective reviews of products and services – authentication and validation mechanisms record and store meaningful reviews in the database.

- spending habits of its account holders – repeated transactions of a product or service imply higher customer satisfaction and discontinuation implies the reverse.

The ValiDeck platform does not require you to provide any confidential information about yourself (e.g. Name, Email, Phone Number) at the time of account creation. You create an account on ValiDeck via a Unique ID generated by an institution that already has your personal details (e.g. Bank, Passport Office, Motor Transport Office). Your ValiDeck ID will be generated via a one-way hash algorithm to ensure that nobody is able to reverse the ID and obtain your personal information.

The tokenization process will register all of your payment cards into your ValiDeck account. Thereafter, every time you use any of the tokenized cards for a transaction, a copy of the transaction record will be saved into your ValiDeck account. The association between your transaction records and your name will be known only to you and your trusted network. The transactions will be totally anonymous to ValiDeck or any other entity.

The Token-based Loyalty Program allows you to join unlimited merchant loyalty programs via your ValiDeck account. Since your ValiDeck account conceals your identity, any merchant loyalty program that you join, will not know your personal and confidential information.

When you initiate a transaction with a business that is a ValiDeck partner, the transaction will trigger a process to determine if the payment method that you’re using (cash or card) is associated with a ValiDeck account. If you’re paying with cash, the process will read the QR code on your smartphone. If you’re paying through card, the process will request a token number of the card from the issuer. Reading the QR code will link the partner account with your ValiDeck account. The token number of your card will provide your ValiDeck account and link it with the partner account.

When you join the loyalty program of a business, the merchant/vendor gives you cashback/reward points for transaction volume and also for sharing your purchasing behavior with them. Your purchasing behavior provides insights about tastes, preferences, and buying habits, which helps the merchant/vendor optimize their business.

The loyalty program is typically linked to a merchant-specific card or a unique identifier, such as a phone number or email id. When you use either of these two means (Card or ID), the merchant gives you cashback/reward points only for the transactions done at their store or partner network. The merchant does not know about your transactions at other stores and therefore, their understanding about your purchasing behavior is very limited.

The ValiDeck platform allows you to capture all of your transaction records at a central location on the cloud. When your transaction records are stored in a centralized database, you can negotiate a significantly better membership agreement with the merchant/vendor. For instance, you can tell the participating business that you would share all of your transaction records across a vertical (e.g. Grocery or Travel) in exchange for higher cashback/reward points. Many businesses will be happy to give you enhanced benefits and you’ll be able to profit from your transaction records.

Big businesses have huge budgets for acquiring market insights and attracting customers. They’re able to set up and operate loyalty programs through which they reward customers with cashback/points and also gather information about their purchasing behavior. It costs tens of thousands of dollars to set up and operate a card-based loyalty program via the payment network.

The ValiDeck concept significantly lowers the cost of running a loyalty program, thus allowing small businesses, such as a stationery/gift shop, clothing boutique, or convenience store to compete with big businesses. The token-based loyalty program can be run with a modified payment cube and an Internet-ready terminal device, such as a tablet. It does not require the business to issue a co-branded card in order to enroll a customer into their loyalty program. In addition, it also does not require customers to provide their confidential information, such as phone number or email id to register in the loyalty program.

We anticipate that the cost of running a simple token-based loyalty program will be a couple of hundred dollars per annum. This will be sufficient for small businesses to acquire market insights to help them optimize their operations and grow their business. For instance, the token-based loyalty program will allow a café owner to receive the transaction records of participating customers for transactions outside their store and know what kind of food they eat at other places. The information gathered will help the café owner introduce new products in their shop. This will be a significant advantage because even big businesses that run card-based loyalty programs only understand a subset of the purchasing behavior of their customers.