Token-based Loyalty Program

Tokenization has revolutionized mobile and online payments. When you add a payment card to your mobile device or Amazon account, the card information is not saved on the mobile device or Amazon’s servers. Instead, a random string of characters called a token, is saved on the device or server while the card information is stored in a secure vault operated by a token service provider (TSP) and mapped to the token. If your mobile device gets stolen or your Amazon account gets hacked, the payment card information is protected because it was never stored on the device or server. When you initiate payment via your mobile device or Amazon account, the transaction details are forwarded to a TSP, which retrieves your card information and provides it to your payment card processor, such as Visa or MasterCard. Thereafter, the journey of your payment card transaction is similar to a transaction without involving tokens. The processor sends an authorization request to your payment card issuer. If the issuer approves the transaction, the processor sends the approval message to the acquiring bank, and the transaction is completed.

Payment card tokens were first introduced in the early 2000s as part of an industry-wide effort to enhance the security of digital payments. However, they became popular only around 2014 when industry leaders like Apple, Google, and Amazon adopted tokenization as a standard security measure for payment card transactions.

What is a Loyalty Program

A merchant loyalty program is a marketing strategy designed to encourage customers to continue making purchases from a retail store or partner network. The program rewards customers for repeat purchases through points, discounts, cashback, or other incentives. Merchant loyalty programs can be broadly classified as card-based or ID-based. To enroll in a card-based loyalty program, you must acquire a merchant loyalty card, which is also bundled with credit nowadays. The merchant loyalty card is analogous to any payment card and can be used outside the merchant’s establishment, too. You become eligible to receive a merchant loyalty card after the merchant has established your credentials. This means you must provide copies of two pieces of your official ID (passport, driving license, social security, health card) to the merchant. To enroll in an ID-based loyalty program, you must share your email ID or cellphone number with the merchant.

Both card-based and ID-based methods allow the merchant to track the spending behavior of the customer and reward him/her for their purchases. When a customer makes a purchase through the merchant-specific loyalty card, the payment cube can read the customer information embedded in the loyalty card. Once the customer information is obtained, the merchant’s POS terminal records the customer transaction in the customer’s account of the Merchant Loyalty Program database. Alternatively, if a customer makes a purchase using cash, he/she provides the merchant with their email address and/or cell phone number. The merchant types the customer information in their POS terminal and records the transaction record in the customer’s account of the Merchant Loyalty Program database.

Data Protection Issues in Loyalty Programs

The customer information acquired through the existing loyalty programs is highly vulnerable to data breaches. Retail merchants often work with credit reporting companies (CRAs) to collect and aggregate customer information sourced through merchant loyalty programs. This data is then used to generate credit reports and credit scores, which lenders and financial institutions use to assess an individual’s or business’s credibility. In the United States, there are three major CRAs: Equifax, Experian, and TransUnion. Equifax suffered a major data breach in 2017 in which the private records of 147.9 million Americans, along with 15.2 million British citizens and about 19,000 Canadian citizens, were compromised. The information accessed in the breach included first and last names, social security numbers, birth dates, addresses, and in some instances, driver’s license numbers for an estimated 143 million Americans. It is estimated that the breach cost Equifax over $1.7 billion in direct and indirect costs, including legal settlements, regulatory fines, customer compensation, security upgrades, and reputational damage.

What is a Token-based Loyalty Program

Although payment card tokens were invented to improve the security of online transactions, the underlying technology can have multiple use cases. The Token-based Loyalty Program (US12125054B2) repurposes the tokenization standard for running a merchant loyalty program that will allow payment cardholders to participate in unlimited merchant loyalty programs without acquiring additional loyalty cards or sharing their email ID/cellphone number. Customers don’t purchase goods and services from only one vendor, even if the vendor can provide all the goods and services the customer wants. Customers purchase goods and services from multiple vendors who compete with each other. If the customer acquires a loyalty card from each of these vendors, it creates problems for the customer as well as the vendor.

The first problem is that when a customer shares their private and confidential information with the merchant, there is a risk that the information might get into the wrong hands. Additionally, the customer has to accept the burden of managing another card. The second problem is that a card-based loyalty program provides a merchant with very limited visibility of the purchasing habits of the customer. For instance, a customer who has acquired a Starbucks loyalty card only provides information about their purchases at Starbucks. The same customer might be visiting many different eating places, such as Barista, Pizza Hut, and McDonalds, and the customer spending at these places would be of interest to Starbucks in order to diversify their menu. However, since this spending is hidden from Starbucks, it can only speculate about the customers’ eating choices.

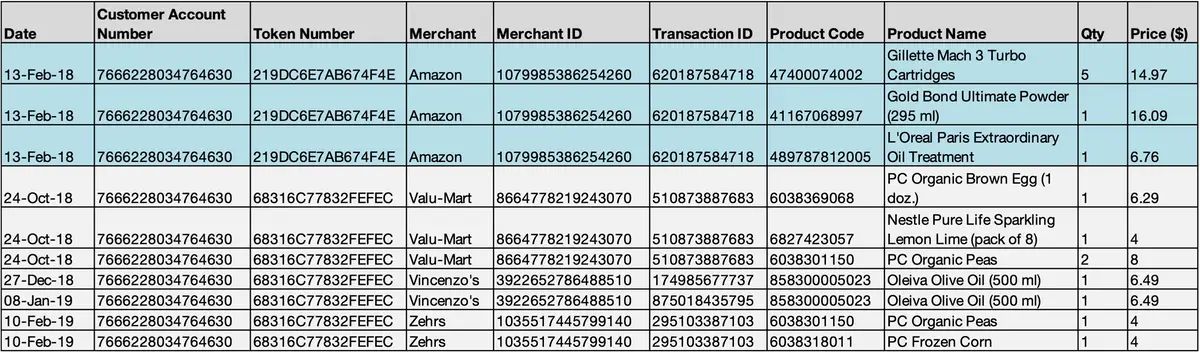

The digital infrastructure for token-based loyalty programs allows customers to create personal accounts on a server platform on the cloud and save all transaction records anonymously into their accounts. In the following table, a customer has anonymously captured his transaction records at multiple vendors into his online account. The customer can profit from this information by sharing it with a merchant who wants to understand the customer’s purchasing behavior and optimize their marketing and supply chain.

How Token-based Loyalty Program Works

Tokenization allows both merchants and customers to benefit from the security and reliability of the digital infrastructure supporting payment card tokens. The token-based loyalty program uses tokens to link a customer transaction record with the payment card used for the transaction. This invention is brand new and has never been used anywhere in the world. ValiDeck has filed a patent for this invention in six jurisdictions — Canada, USA, Europe, India, China, and Australia — and received an allowance for the invention in the USA and Australia.

To understand how the token-based loyalty program works, imagine a customer named Alice who wants to enroll herself in the Ardus merchant loyalty program. Ardus is a fictitious boutique design shop that sells home-use products, such as bed sheets, table linen, curtains, and sofa upholstery. Ardus has deployed a customized point of sale (POS) at its store that allows its customers to save their transaction records anonymously into a server database on the cloud. Customers can purchase products from Ardus by physically visiting their store or online. The customized POS is part of the token-based loyalty program solution.

Alice uses the following steps to enroll herself in the Ardus Merchant Loyalty Program and earn rewards for her transactions at Ardus and other merchants using the token-based loyalty program infrastructure developed by ValiDeck.

1. Registration

Alice generates a cryptographic key pair (public/private) and asks her bank to attest her public key, since the bank already possesses her verified identity documents. The bank attests Alice’s public key using its existing KYC records and later generates and manages her payment card token within its own secure environment, without disclosing any personal or card-related information to ValiDeck. Alice then submits this attested key to ValiDeck, which issues her a unique, privacy-preserving ValiDeck ID. This ID becomes the reference point for all her future transactions and reviews — without ever revealing her real identity.

2. Tokenizing

- Alice requests her payment card issuer to tokenize her payment card.

- The card issuing bank tokenizes the payment card and encrypts the token with the ValiDeck public key. The token is then stored in the issuer database as a Key:Value pair with the matching card number.

- The card issuing bank sends the encrypted token to ValiDeck. The tokens can be decrypted only via the matching private key available on the ValiDeck platform.

- ValiDeck decrypts the token and stores it in a queue. It then notifies the issuer, which informs Alice that the token is available for registration.

- Alice registers the token into her personal account on the ValiDeck platform.

3. Linking

- Alice purchases some products at Ardus and initiates a payment at their store.

- The Ardus point of sale (POS) requests their acquiring bank to authorize the transaction and share the token number linked to the card. The acquiring bank forwards this request to the payment network, which subsequently passes it to the payment card issuer.

- The card issuing bank checks Alice’s bank account balance and authorizes the transaction. The authorization and the linked token number are sent to the payment network, which forwards them to the acquiring bank. The token number is encrypted with the ValiDeck public key.

- The Ardus POS receives the transaction authorization and the token number from the acquiring bank. The transaction record is linked with the token number via an API call and transmitted to the ValiDeck platform.

- The ValiDeck system decrypts the token number and looks up Alice’s account containing the token number. Once Alice’s account is found, the transaction record is written into the ValiDeck database and linked to Alice’s account number.

4. Earning Rewards

Alice earns reward points from Ardus for her purchases at the store and for selectively sharing her anonymized transaction history from other home-use merchants, such as Bed Bath & Beyond, Kohl’s, and Williams-Sonoma. The reward logic is executed automatically through the ValiDeck platform, ensuring that merchants can offer incentives transparently and customers can retain full control over what data they choose to share. Alice’s aggregated transaction records, visible only in anonymized form, help Ardus and other merchants optimize their marketing and supply-chain strategies.

Benefits of the Token-based Loyalty Program

The token-based loyalty program establishes a privacy-first digital infrastructure that unites customers, merchants, payment channels, and regulators within a shared framework of trust and accountability.

For customers, it removes the need to register separately with every merchant or share personal details to earn rewards. A single, anonymous ValiDeck ID enables participation across multiple loyalty programs while preserving complete control over what data is shared. This approach restores digital autonomy and ensures compliance with global data-protection standards such as the GDPR.

For merchants, it provides a secure and interoperable loyalty framework that integrates seamlessly with existing payment infrastructure. Merchants can access anonymized insights into purchasing behavior, helping them refine products, pricing, and supply-chain operations—without ever accessing personal identifiers.

For payment channels, it unlocks new business opportunities through privacy-compliant analytics, token-attestation services, and standardized data interfaces. By promoting greater trust and usage of digital payments, payment networks can expand transaction volumes while adhering to strong security and privacy requirements.

For regulators, it introduces a transparent governance layer that preserves jurisdictional sovereignty while ensuring interoperability among participating regions. Each regulator maintains full oversight of data and activity within its own domain, supported by a standardized framework that enables auditability, fairness, and cross-border compatibility. This design strengthens public trust, aligns with national data-protection mandates, and encourages responsible innovation within a unified digital infrastructure.

Collectively, this ecosystem redefines loyalty as a trusted public utility — where privacy, innovation, and economic growth advance together under a transparent governance model.